travel nurse state taxes

There are two main types of taxes that you will need to pay as a travel nurse. Basically only income earned in California is taxed there.

How Much Do Travel Nurses Make Nursejournal Org

But many states including California use a percentage based approach to figuring out taxes due plus different personal exemptions so it may not be exact per my first sentence.

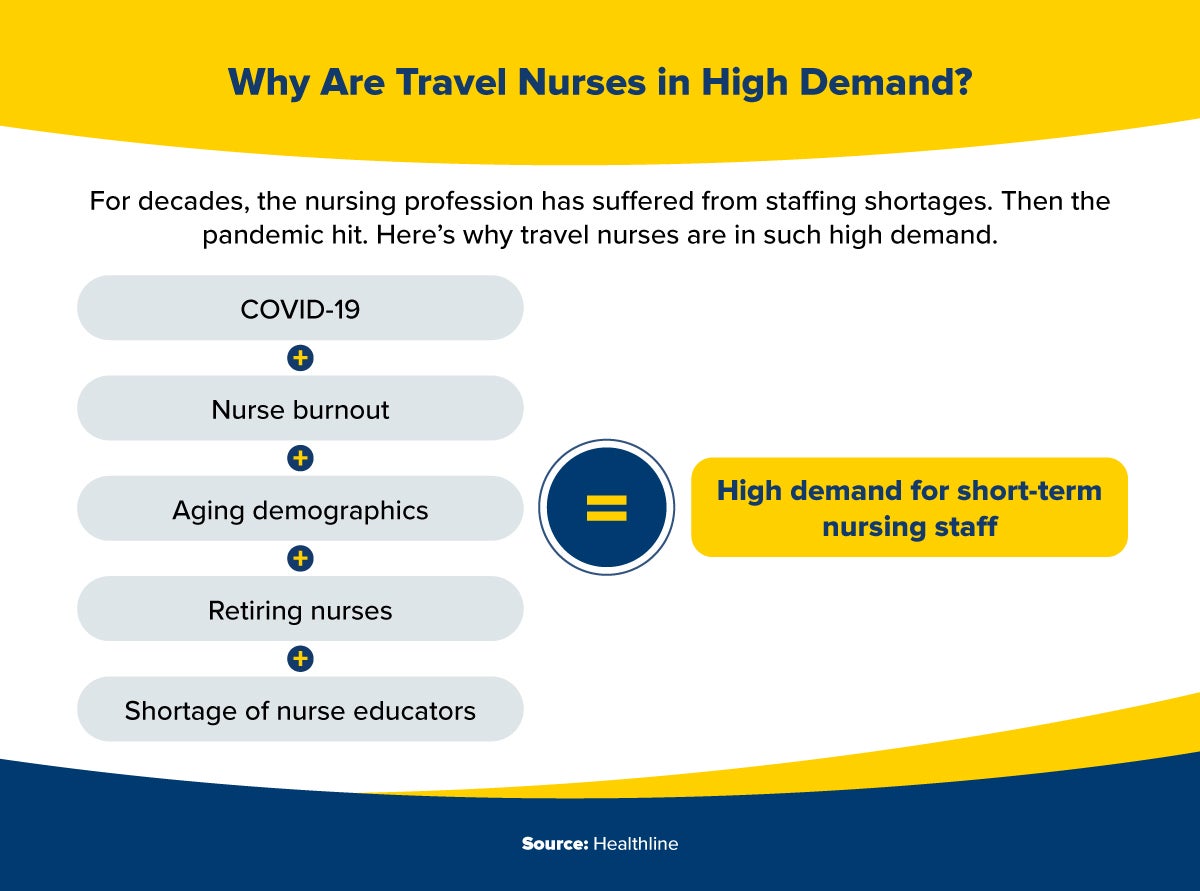

. Because travel nurses are paid a bit differently than staff nurses so too do travel nurses file taxes a bit differently. Travel nurse positions have become more popular than ever. The following states and jurisdictions do not have an income tax.

Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses. Since travel nurses normally dont earn the majority of their income in the location of their permanent residence they would choose option one. You will need to pay federal income tax on any.

In California the bill rates can vary dramatically. What taxes do travel nurses pay. This means travel nurses can no longer deduct travel-related expenses such as.

Also nurses are free to go anywhere in their breaks. Travel nurses should bear in mind that they must file non-resident tax returns in every state they have worked in as their wage income will be subject to tax in every state in which they perform. Not just at tax time.

Youre often filing in multiple states and dealing with uncommon concepts like per diems. Alaska Washington Wyoming Nevada South Dakota Tennessee Texas Florida New Hampshire USVI and the District of. In most states bill rates tend to hover within a decent range.

Travel Nurse non-taxable income. If you were working as a Staff Nurse you would typically be unable to write off housing travel or food expenses on your taxes. For nurses domiciled in a compact state the filing of a resident tax return is universally expected for.

Know the Tax Implications. This is the most common Tax Questions of Travel Nurses we receive all year. Travel nurse salary is different for each assignment but it generally comes with a generous hourly rate which is taxable income as well as tax-free stipends for things like housing and travel.

May 9 2019. You may be subject to state income tax in both the state of your permanent residence and the states where you had travel nurse jobs. To help you navigate your travel nurse.

Federal income taxes according to your tax bracket. When travel nursing companies advertise pay rates they will often tell you a blended rate. Hospitals are turning to them at record rates to fill personnel shortages and.

FREE REVIEW OF PREVIOUSLY. You will often hear people assert that California has the best pay. You may need to pay four taxes as an independent contractor.

In order to make the most of your deduction opportunities it is best to. This is because travel nurses are paid a base hourly rate that. It is also the most important since the determination of whether per diems.

As a travel nurse there are a number of business deductions you will be able to take come tax time. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. But it is pretty close.

A blended rate combines an hourly taxable wage such as 20 an hour with your. Federal income tax and state income tax. State Income Taxes as a Travel.

Travel nurse taxes can be especially tricky. States have a state. Its not enough to simply abandon a residence but establish a new one.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike.

State Tax Questions American Traveler

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

Travel Nursing Tax Guide Wanderly

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Faqs About Travel Nursing Fastaff Travel Nursing

Understanding Travel Nurse Taxes Guide 2022

Travel Nurse Taxes Overview Tips

Travel Nursing 101 How To Be A Travel Nurse More Tnaa

Travel Nursing Salaries Could Be Capped As Legislators Call For Investigation

Travel Nurse And Allied Tax Homes Tax Free Traveltax And I Talk About It All It S Amazing Youtube

Pros And Cons Of A Travel Nurse Spring Arbor University Online

Everything To Know About Travel Nurse Taxes For 2023 Nurse First Travel

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing

Travel Nursing Pay Qualifying For Tax Free Money 3 Bluepipes Blog

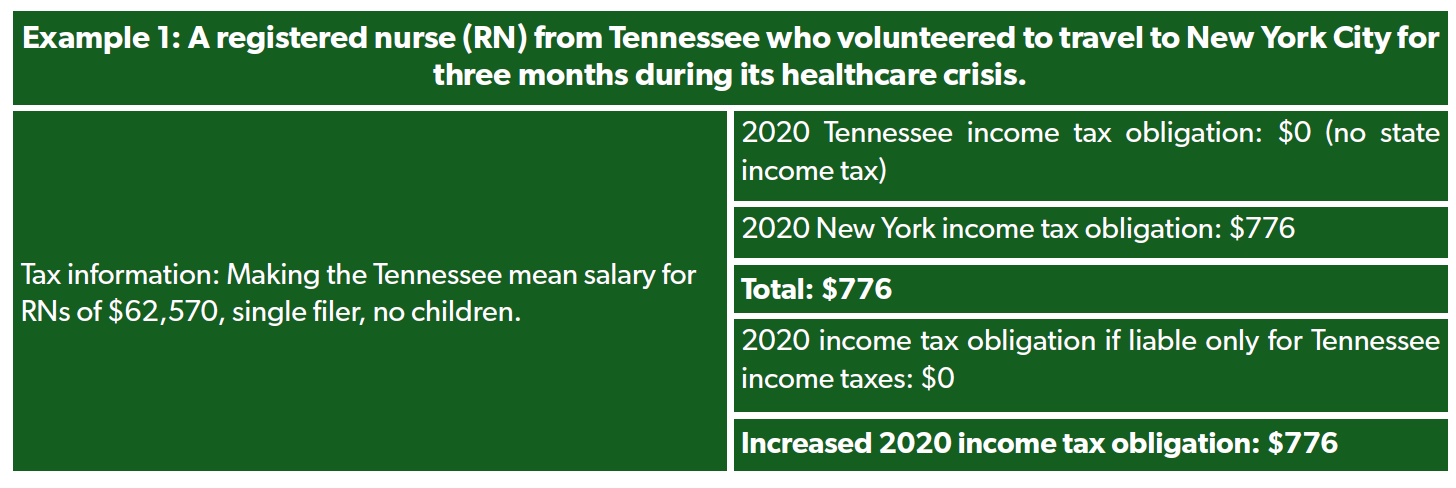

New York S Aggressive Pandemic Tax Strategy Underscores Need For Congressional Action Foundation National Taxpayers Union